27+ new reverse mortgage rules

Looking For Reverse Mortgage Scheme. Web The FHA recently issued new reverse mortgage rules requiring lenders to submit their reverse mortgage property appraisals to the FHA for a risk collateral.

Reverse Mortgage Age Requirements For 2023

You could use up your equity.

. Web A reverse mortgage can limit your options down the road. Generally a reverse mortgage must be paid back when you die or move from the home. Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

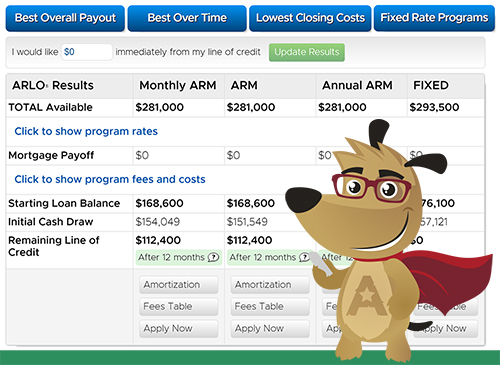

The only reverse mortgage insured by the. The new reverse mortgage rules severely limit the amount of cash you can receive upfront and during the first 12 months of the loan. Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator.

Web The rules for reverse mortgages say that the property on which you have the reverse mortgage must be your principal residence meaning that it must be where you. Web Reverse mortgages allow people 62 and older to tap their home equity without having to pay the money back until they move out sell the house or die. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Ad An Overview Of Reverse Mortgage And How It Works. Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Are 62 years of age or older occupy the property as a principal residence and own the home outright.

Compare Top Results from the Web Simply. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Less total money.

Ad Find Reverse Mortgage Pros And Cons. Choose Between Multiple Options and Find what you are Looking for. Ad Compare a Reverse Mortgage with Traditional Home Equity Loans.

Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home In addition the loan may need to be paid back sooner such as if you fail to pay. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage.

Ad Can the loan improve your emotional and financial well being. Is it right for you now. Web Less upfront cash.

Ad Compare a Reverse Mortgage with Traditional Home Equity Loans. Web Up to 25 cash back Reverse mortgages are only available for homeowners who. Web Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their income.

Web Under the new rule most mortgage servicers are required to take certain steps to help homeowners in forbearance find options for repaying their loan.

2021 Reverse Mortgage Limits Soar To 822 375

2023 Reverse Mortgage Lending Limits Remain High

:max_bytes(150000):strip_icc()/GettyImages-487701721-27c74f2424bc4415bb881e859134f468.jpg)

Reverse Mortgage Rules By State And D C

Hecm Reverse Mortgages Current Borrowing Limits May Not Last Much Longer

Reverse Mortgage Age Requirements For 2023

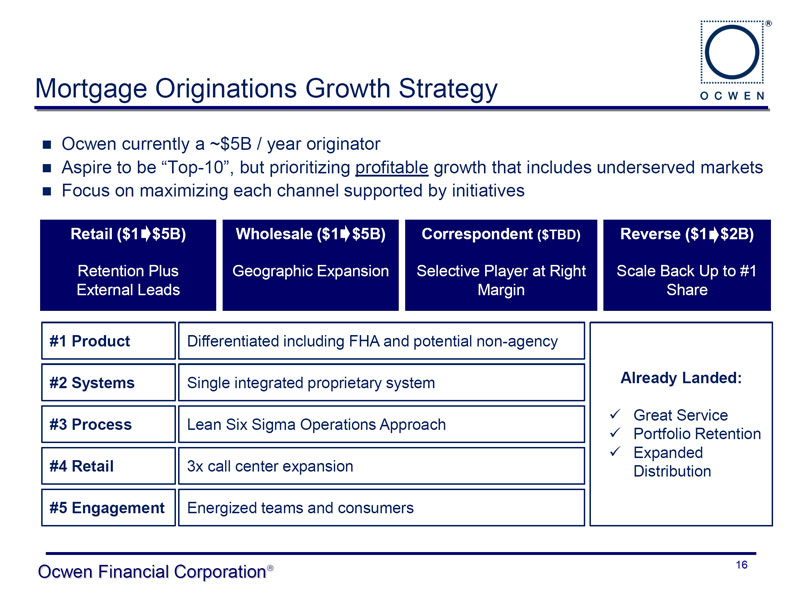

Form 8 K Ocwen Financial Corp For Feb 29

5 Rules That Apply To Reverse Mortgages In 2023

Hecm Reverse Mortgages Current Borrowing Limits May Not Last Much Longer

Flagship 10 27 16 By Military News Issuu

The New Reverse Mortgage

2020 Reverse Mortgage Changes New Limits New Programs

Cmp 13 07 By Key Media Issuu

2010 October

Tougher Reverse Mortgage Rules What You Need To Know

Reverse Mortgage Guide On Reverse Mortgage Loan Scheme

2021 Reverse Mortgage Limits Soar To 822 375

2017 Reverse Mortgage Limit Increased To 636 150 Mls Reverse Mortgage Powered By Zyng Mortgage